Accelerating SAP Integrations with Akeneo: A Strong Foundation for Complex Systems

SAP S/4HANA and SAP Commerce Cloud are powerful platforms, but integrating them into a flexible, scalable product data ecosystem is rarely simple. That’s why we’re breaking down how Akeneo’s SAP Accelerators provide a proven, SAP-native starting point for connecting ERP, PIM, and commerce. Discover what the accelerators are, who they’re built for, and how they help teams reduce integration friction today while preserving the flexibility needed to evolve and scale tomorrow.

SAP S/4HANA and SAP Commerce Cloud are powerful, enterprise-grade platforms. They’re designed to handle massive volumes of operational and commerce data, support complex global business models, and scale as organizations grow.

But anyone who has worked in a real SAP environment knows the truth: integrating SAP systems into a modern product data architecture is rarely simple.

Each SAP landscape is different. Data models vary. Customizations stack up over time. And product data doesn’t live neatly in one place; it flows between ERP systems, PIM solutions, commerce platforms, and dozens of downstream channels. There’s no universal “plug-and-play” integration that works for everyone.

That’s exactly what Akeneo’s SAP Accelerators are built for.

Rather than offering rigid, black-box connectors, Akeneo provides accelerators that reduce initial integration friction while preserving the flexibility enterprises need to evolve, customize, and scale over time.

Let’s take a closer look at how they work, who they’re designed for, and why they matter.

SAP Complexity and the Product Data Challenge

SAP S/4HANA and SAP Commerce Cloud both rely on rich, highly structured data models. That power comes with complexity.

No two SAP implementations look exactly the same as business rules, extensions, custom objects, and industry-specific requirements all shape how product data is stored and used. As a result, integrating a PIM into an SAP ecosystem is never just about moving data from Point A to Point B.

A successful integration requires careful orchestration between:

- ERP systems that manage operational and transactional data

- PIM systems that enrich, localize, and structure product information

- Commerce platforms that activate that data across digital touchpoints

Shortcuts and overly rigid connectors might promise speed, but they often create long-term pain that limit flexibility, make governance harder, and slow innovation down the line.

Akeneo’s SAP Accelerators take a different approach.

What Are Akeneo’s SAP Accelerators?

Akeneo’s SAP Accelerators are integration blueprints designed to help teams connect SAP environments with Akeneo Product Cloud faster without locking them into inflexible workflows.

They’re built using SAP-native technologies and follow SAP best practices, giving enterprises confidence that integrations will scale, perform, and remain governable over time.

SAP S/4HANA Accelerators

The SAP S/4HANA Accelerators are delivered as prebuilt iFlows on SAP Business Technology Platform (BTP), using SAP Integration Suite.

Importantly, these are not monolithic connectors. They’re reusable integration artifacts that teams can configure, extend, and adapt to their own landscape.

Key capabilities include:

- Support for both batch synchronization (ERP → PIM) and event-driven flows (PIM → ERP)

- Message mapping logic aligned with common SAP data patterns

- Workflow templates for scheduling, orchestration, authentication, and filtering

This gives teams flexibility to choose the integration model that fits their business, whether they need high-volume batch processing, near real-time updates, or a mix of both.

Learn more about Akeneo’s SAP S/4 HANA Accelerators

SAP Commerce Cloud Accelerator

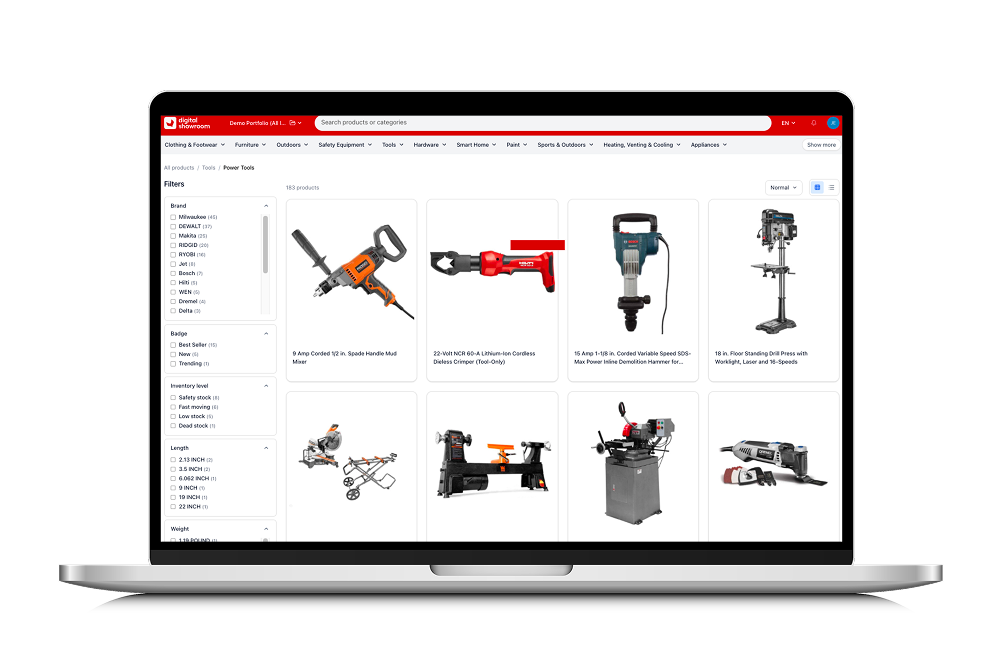

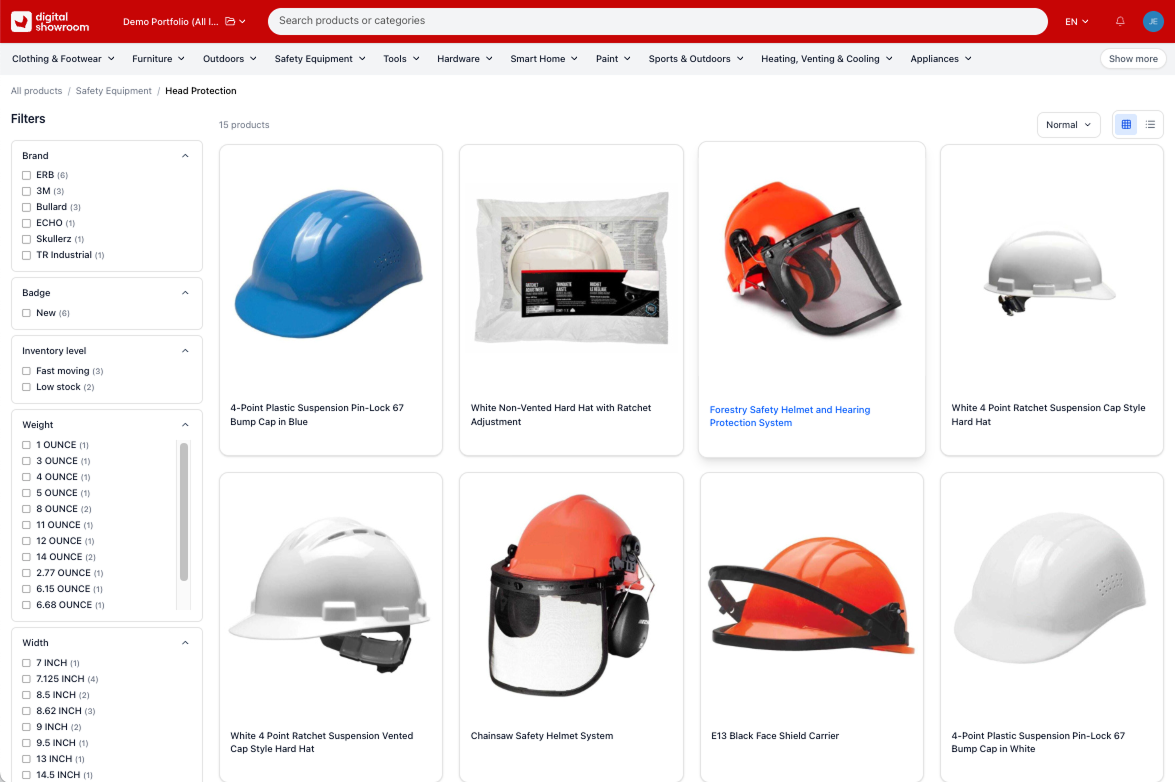

The SAP Commerce Cloud Accelerator provides a low-code option to synchronize rich, localized product information from Akeneo PIM into SAP Commerce Cloud.

Built on SAP Integration Suite and integrated into the SAP BTP toolkit, it enables technical teams to:

- Configure and transform product data to meet complex commerce requirements

- Reduce custom development while maintaining control over data flows

- Activate enriched product experiences faster across commerce channels

Rather than reinventing the wheel, teams get a clear blueprint that accelerates integration while leaving room for customization.

Meet with an Akeneo Expert Today to Start Your PX Journey

Why Akeneo’s Accelerator Approach Works

Akeneo’s SAP Accelerators deliver value not by oversimplifying SAP, but by respecting its complexity.

Here’s what that means in practice.

1. Reduced Initial Friction

Building SAP integrations from scratch is time-consuming and resource-intensive. The accelerators provide a ready-made foundation so teams don’t have to start with a blank slate.

By handling core integration patterns, mappings, and workflows upfront, they significantly reduce manual effort and early-stage complexity, which is especially helpful when dealing with SAP’s intricate data structures.

2. Flexibility Built In

Because these accelerators are built on SAP’s native integration tools, teams retain full control over integration logic, governance, and extensions. As business requirements evolve, integrations can evolve with them without ripping everything out and starting over.

3. SAP-Native by Design

By leveraging SAP BTP and SAP Integration Suite, the accelerators ensure:

- Enterprise-grade scalability and security

- Alignment with SAP best practices

- Compatibility with existing SAP governance models

This SAP-native approach makes life easier for IT teams and system integrators, and reinforces Akeneo’s role as a true partner within the SAP ecosystem.

4. Faster Time-to-Market

With integration plumbing accelerated, teams can focus on what actually drives value: enriching product data, improving customer experiences, and launching new products faster.

When enriched product information flows smoothly into SAP Commerce Cloud and downstream channels, brands can activate compelling product experiences without unnecessary delays.

Start Smart & Scale with Confidence

The team here at Akeneo works closely with SAP and ecosystem partners to deliver solutions that reflect real enterprise realities. Instead of locking customers into rigid connectors, the accelerator approach embeds integration logic where customers and integrators can see it, govern it, and customize it.

Our goal is to provide a smart, SAP-native starting point for integrating SAP S/4HANA and SAP Commerce Cloud with Akeneo Product Cloud in order to reduce friction, preserve flexibility, and help teams scale confidently without sacrificing control.

For enterprises navigating complex SAP landscapes, that balance makes all the difference.

If you’re interested in learning more about Akeneo’s SAP Accelerators, you can learn more here, or reach out to an Akeneo expert today to get started.

Are you ready to take the next step?

Our Akeneo Experts are here to answer all the questions you might have about our products and help you to move forward on your PX journey.

Shopify

Shopify

Adobe

Adobe

Salesforce

Salesforce

SAP

SAP